State of the Market for British Classics

Sean Rooks | October 13, 2025

While randomly searching for cars of interest over the weekend, I came across an attractively priced 1964 Triumph TR4. The TR4 is one of my favorite classic vehicles, mostly due to its gorgeous Michelotti-design bodywork. I was surprised to see a generally very solid car offered for such a reasonable price. Was this a result of waning interest in classics from the 50s and 60s, or are British classics seeing a market decline in general? In today’s Market Monday, I’ll be taking a look at the state of the market for British classics to find out.

The List

It’d be rather challenging to assess every vehicle that could be considered a British classic car in the time available to write this piece. So, like Hagerty, I utilize a cross section of vehicles to represent the market as a whole. I’ve selected the cars below based on a few criteria — popularity, price and type (grand touring, roadster, 4×4). Here are the vehicles selected:

- Aston Martin DB5

- Jaguar E-Type Series 1

- Land Rover Defender 90 NAS

- MGB Mk1

- Triumph TR6

Yes, I could have included other great British brands like Lotus, TVR, Caterham, Bentley, Rolls-Royce and the like but I wanted to keep the size of the list manageable. The Aston Martin DB5 is a representative of blue chip collectibles, while the MGB neatly addresses affordable classics.

Market Snapshot

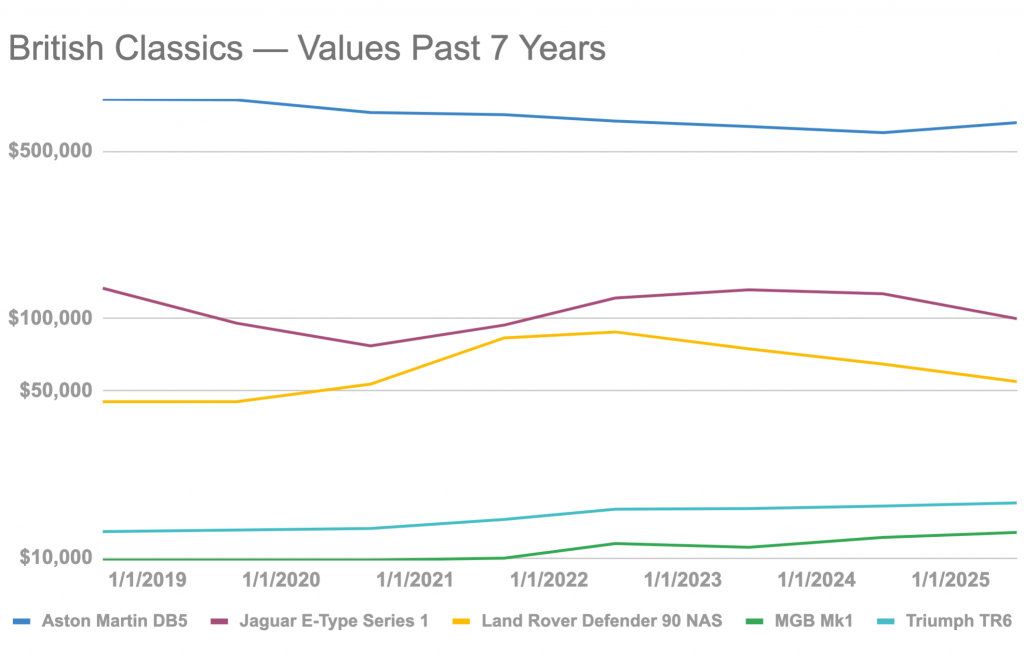

For this research, I chose to utilize market data from Hagerty, since it reaches back before the pandemic. Hagerty tracks values across 4 different conditions from “concours” to “fair.” For simplicity this data is for “good” condition cars, which make up most of the classics on the road. The spike in values due to Covid didn’t affect all cars as you’ll see, but it had an impact on most of the market and it’s easier to see when you start the graph in 2018.

As the chart below demonstrates, not every car saw a value increase during this period and not every car was affected by recent market softening. Values for the Land Rover Defender 90 and Series 1 Jaguar E-type definitely saw a pandemic-induced bump that has since softened, while the remaining cars appear to be trending up or down.

The Aston Martin DB5 has declined in value pretty steadily from highs in the mid 2010s, with a slight uptick in the summer of this year. That average has since ticked down since October, however.

A welcome observation is the steady increase in value for cars at the lower end of the market. The Mk1 MGB has seen steady growth in the last several years, as has the Triumph TR6. You’d probably do better in the stock market, but the rate of growth matches a good money market fund.

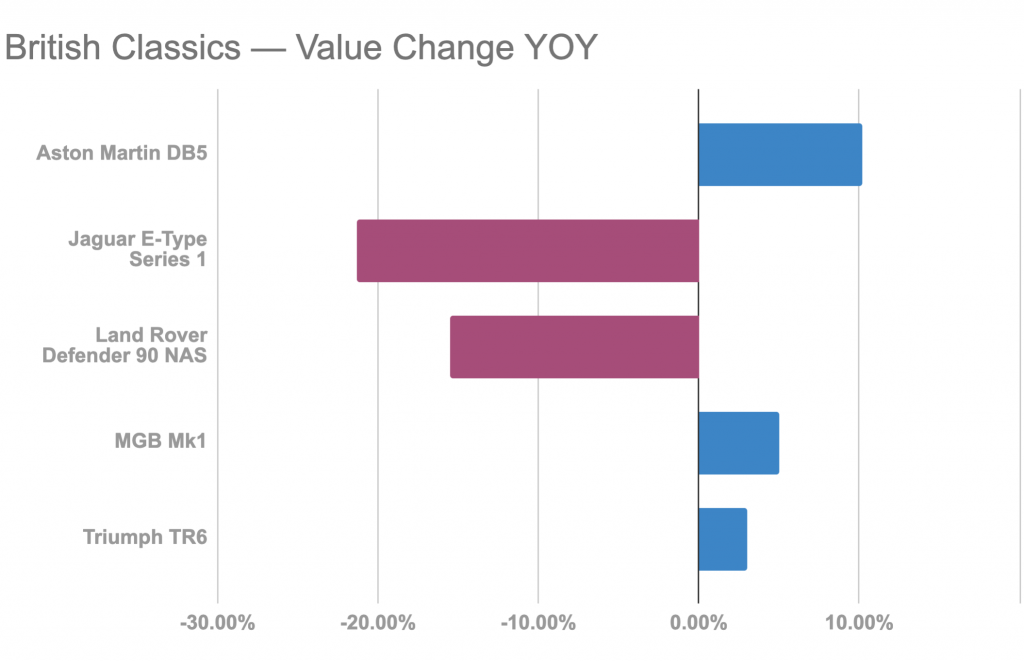

The year-over-year growth picture for our list tells a pretty interesting story. Note that the data here is yearly through July 2025. The last year or so has witnessed the market cooling off pretty significantly for most cars, so the significant dips for the Jaguar E-type and Land Rover Defender 90 NAS aren’t surprising as they had the largest boost from the pandemic buying spree. If you own an Aston Martin DB5, the 10.2% increase may give you some hope, but values have retreated again with an 11% decline from July to October of this year.

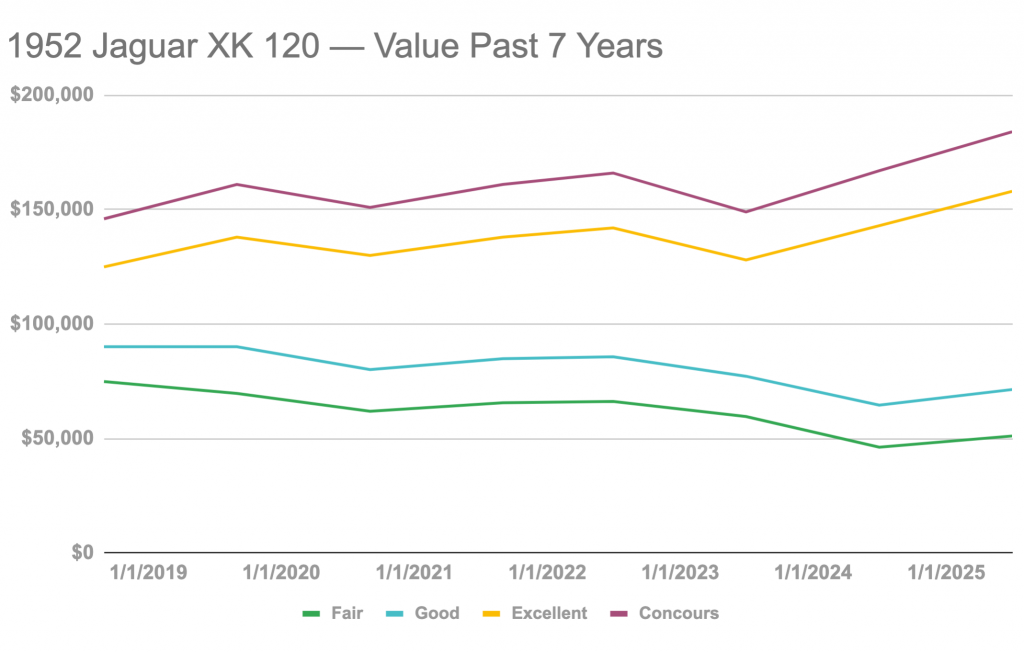

Some of the movement at the lower end of the market is due to price at the higher end, but some of the negative movement at the high end of the market is due to other factors. The data presented above looks at “good” condition cars, or vehicles that have no obvious flaws and drive well but are far from perfect. Excellent and concours-quality cars may actually be flat or less depreciated than their lessers. The Jaguar XK-120 is a great example of this, as you can see in this chart from Hagerty:

Skyrocketing restoration costs for high-end cars continue to elevate the prices for perfect examples and depress prices for more average cars.

Final Thoughts

Based on what I see in the data I believe British classics have some life left in them, especially at the more affordable end of the market. Not many enthusiasts can drop $800,000 on an Aston Martin DB5, but a lot of prople can stretch to add a good MGB to their garage. It’s not just older folks buying those cars either, as my brother just acquired one and the MGB predates his birth by about 15 years.

Restoration costs will most likely continue to be a driver of high prices for perfect cars and push down the values of lesser quality examples. Perhaps the old adage of “buy the best example you can afford” is the sagest advice in this market.

This assessment focuses on classic cars, or generally those built before the “rad-era” of the 1980s and 1990s. I’ll have to dedicate a future article to a state of the market for more modern British cars.

In the meantime — have a great week, everyone!

Wolf and Mare provides car finding, appraisals, and auction services for buyers and sellers of collector European cars. If you’re interested in acquiring an overseas car, give us a call or drop a line!