Diminished Value Appraisal: What It Is & Why You Need One

Sean Rooks | February 16, 2026

When you get in a vehicle accident, you’re not only dealing with the stress and emotions from the incident itself, but also the complexity of dealing with insurance and repair companies in the aftermath. Insurance is intended to make you whole after a loss, but simply repairing your vehicle may not fully compensate you after an accident. For some vehicles, the market value of your car can be permanently reduced even after your car is repaired. In this week’s Market Monday, we’ll be explaining diminished value appraisal, how it works and when you need one.

What is Diminished Value?

Diminished value, also called diminution of value, is the reduction in an asset’s market value following an accident even after professional repairs are completed. This can apply to fine art, antiques and most commonly a vehicle. Since buyers are willing to pay less for a car with an accident history, collision and the subsequent repairs can permanently reduce the market value of your vehicle.

There are three types of diminished value:

- Inherent diminished value: The most common type of diminished value claim. This loss of value is due solely to an accident being added to the vehicle history record. This type of claim can be challenging to prove.

- Immediate diminished value: A rarely used loss-of-value claim made before the damage is repaired. If for some reason an owner decided to trade in or sell a vehicle prior to repairs, they could submit a claim for immediate diminished value.

- Repair-related diminished value: Occasionally, a vehicle’s repair work is performed to a standard that is not equal to its original condition or factory-original specifications. Something like a sticking trunk lid after a repair is completed would qualify as this type of diminished value.

Thanks to the generally high-quality repairs carried out by modern body shops, the most common claim is inherent diminished value.

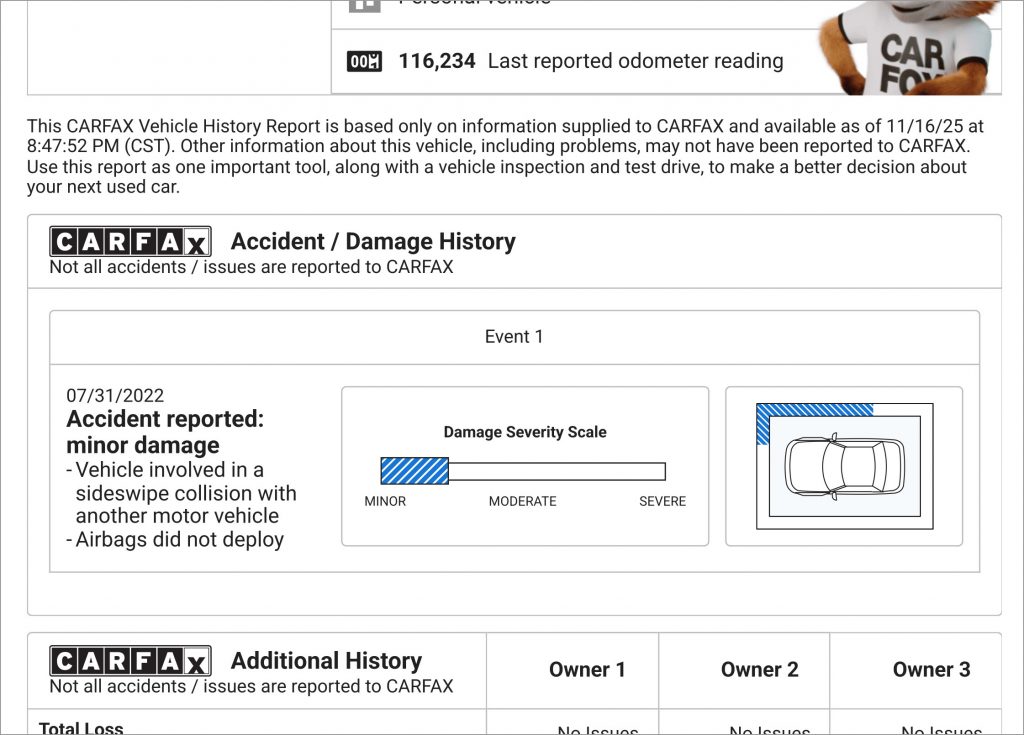

Why would your car be worth less even after a certified body shop repairs your vehicle to factory-original specifications? Accidents that meet certain conditions are typically reported to state DMVs and other sources. Accident history, service data, title changes and more are attached to the vehicle’s identification number. They are compiled by a variety of vendors to create a Vehicle History Report. These reports create transparency for used car buyers by providing information that affect a vehicle’s value, use or registration.

Buyers have consistently shown that they are willing to pay more for a vehicle with a clean history report. A “clean” history is one that’s absent of accidents. Value differentials can range from 10% to 20% or more in some cases.

As a result, many states allow you to file a diminished value claim against the at-fault driver’s insurance. Your rights vary from state to state. Here in Virginia the term “diminished value” is defined in law, but the statute of limitations is 5 years. Also, Virginia does not allow claims against your insurer, just the third-party company.

Georgia is considered the most friendly to diminished value claims, as a court case there has established a precedent. On the other side, Michigan’s laws are structured in a way that makes diminished value claims more challenging. Most states permit diminished claims against the at-fault driver’s insurance carrier only (third-party liability).

How Much Value is Lost After a Vehicle Accident?

There is no universal formula for calculating how much value is lost due to an accident. All cars and cases are different, after all! Numerous variables influence how a car’s value is impacted by a collision and repair:

- The make, model, specification, age, mileage and condition of the vehicle

- Any prior accidents on the history report

- The location and severity of the damage to the vehicle

- The market conditions for the vehicle were at the time of loss

For example, If you own an enthusiast vehicle that depreciates less than usual, you may experience a much greater loss of value after an accident compared to a less desirable car that has already experienced significant depreciation.

You may see reference to a formula stemming from a decision in the Georgia State Court case Mabry v. State Farm. This rule was created by the insurance companies to fill a gap in the framework they use to compensating insured parties for their loss of value. The court accepted State Farm’s submission of the rule in that specific case, but it’s become a de facto insurance standard for diminished value claims. While better than nothing, this formula can generate a diminished value result that is less than the true loss of value.

With this formula, insurance companies impose a 10% cap on lost value off the bat, then reduce the resulting compensation using various multipliers based on the severity of damage and the mileage of the vehicle.

Say you own a car worth $150,000 and the insurance companies cap the loss of value at $15,000. You discover the gap between a clean car’s value versus one with damage is 20% (all other things being equal). In this scenario, you’re losing $15,000 by accepting the output of the insurance companies’ formula. Consider “Rule 17c” — as it is called — a starting point for negotiation and not the final answer.

What is a Diminished Value Appraisal?

The success of a diminished value claim relies on the quality of the evidence that supports it. Your chances of reaching a mutually-agreeable settlement are greatly improved by providing the following:

- A justified opinion of the vehicle’s value prior to the accident

- An assessment of value after repairs have been completed

- Completed sales of similar vehicles in a similar pre- and post-repair condition

- An expert conclusion based on detailed evaluation of the subject vehicle’s specifics

Each of the above components are included in a professional diminished value appraisal.

How a Diminished Value Appraisal is Performed

A professional appraisal is conducted by a third-party appraiser who may work independently or for an appraisal company. They write to a defined industry standard and can be hired by either the insured or an insurance carrier. Just as you have can hire an appraiser to determine the value of your vehicle, the insurance company can also hire their own third-party appraiser during a dispute. Either way, an appraiser typically conducts the appraisal in the following manner:

- He/She will work with you to determine the intended use of the appraisal and the scope of work

- All documentation will be carefully reviewed, including accident details, repair records, the vehicle history, etc.

- The vehicle will be identified and its condition evaluated both before and after repairs were made using the available evidence including an in-person post-repair inspection.

- Comparable sales of similar vehicles will be researched, studied and documented, including vehicles in a condition similar to yours prior to the accident and post-loss.

- Pre-loss and post-repair value opinions will be generated, along with justifications for each.

- Diminished value will be calculated using the appraiser’s research and current market conditions.

- A detailed written report will be generated and delivered.

The benefit in hiring a professional appraiser is primarily in their transparency and commitment to a strict ethics code. An appraiser is not a fiduciary to any party. This means an appraiser’s opinion is final and based only on the evidence and not outside influence. This commitment is critical in maintaining the credibility of the entire industry, so appraisers take ethics very seriously. Courts will also place more value on the opinion of an independent appraiser than a litigant for this reason.

When Do You Need a Diminished Value Appraisal?

If you’ve been involved in an accident and the damage severe enough to involve the police or an insurance company, you may be in a position to require a diminished value appraisal.

A few important conditions must be met prior to engaging an appraiser:

- You were not the at-fault party in the accident

- Repairs to your vehicle have been completed (your car was not totaled out)

- The accident is reported to vehicle history and title services

- Diminished value is ignored or disputed by the insurer

- You expect negotiation or litigation to be necessary in receiving full compensation

Perhaps most importantly, your vehicle needs to be valuable enough to make a credible diminished value claim. Older cars that have almost fully depreciated or are already low in value are unlikely to survive the claims process.

Professional appraisal — third party, unbiased opinion on the loss of value — is usually necessary for diminished value claims, as it provides a credible and justified pre- and post-loss opinion of value.

Why Insurance Companies Dispute Diminished Value Claims

Insurance is intended to make you whole and not to put you in a better position than prior to the loss, plus internal processes, valuation methods and formulas are designed to contain costs. Here are a few ways insurance companies justify denying diminished value claims:

- The value was restored to your vehicle because the repairs “fully corrected” the damage

- Diminished value is not explicitly covered as part of the insurance policy

- Your car is too old or its mileage is too high to experience a loss in market value

It’s possible one or more of those things is actually true, plus insurance companies deal with a ton of fraud. However, the buying public places a stigma on a car that has experienced medium to severe accident damage. Prior damage is used as a negotiating tool by buyers, leading to a loss in value for used cars with an accident history. Cars that depreciate less than others or cars that are appreciating can experience diminished value.

The insurance company is required to make you whole. If you can prove your vehicle is no longer worth what it was prior to the accident even after repairs are made, you can potentially fight for diminished value compensation. Many insurers will deny it immediately, but if you press on and/or submit a claim with well-reasoned and documented evidence of the loss of value, your chances of a settlement increase.

It’s also important to remember that an insurance adjuster works for the insurance company, not for you. They are held to the policies and procedures of the company, so it’s very helpful to have unbiased third-party support on your side.

How a Professional Appraisal Strengthens a Diminished Value Claim

Appraisers use a specific methodology, which varies based on circumstance, to determine the value of personal property. Additionally, appraisers are compensated strictly for the work performed. No other incentive is allowed, meaning they have no stake in the outcome.

The insurance company and the vehicle owner are driven by their own interests. An unbiased third party appraisal shifts the conversation from opinion and bias to one of evidence and impartiality.

A variety of research sources may be used, but an appraisal’s value opinion should always be justified using true market data. This usually takes the form of completed sales on the open market, but it may also be supported by real-world offers. Generic sources such as Kelly Blue Book or NADA Guides are not useful estimates of value in many cases as they do not cover collector vehicles or those that are appreciating in value. Insurance company valuation tools are built to make claims processing easier, not to ensure an objective value determination.

A professional appraisal report is written with the understanding that it may be used in court and the appraiser’s testimony as expert opinion. Therefore, much effort is spent ensuring the appraiser’s conclusions are highly defensible and grounded in fact.

Can You File a Diminished Value Claim Without an Appraisal?

You can certainly file a diminished value claim without an appraisal, conducting the market research on your own. This can be successful for a lower cost claim or where the damage to the vehicle is minor.

Insurance carriers tend to deny claims immediately, likely because many claims aren’t actually valid. This can be due to the age of the vehicle or other factors. In such scenarios, you are unlikely to win a judgement.

A consultation with an appraiser can help you to determine the best approach for your specific case. Honest appraisers will tell you whether your claim is worth the cost of getting an appraisal.

How Much Does a Diminished Value Appraisal Cost?

The appraisal industry has no set standard for the cost of an appraisal due to price fixing laws. Fees are determined by the individual appraiser based on the complexity of the assignment, the local market, and other factors.

A professional appraisal can cost anywhere from $600-$1000 or more depending on the intended use of the appraisal, type of report, and difficulty of the appraisal. Appraisers are not compensated based on the size of a settlement as this would introduce potential bias. As a result, most appraisers bill clients based on actual hours or use a flat fee.

Given these costs, it may not be worth pursuing an appraisal for minor accidents or small losses. Appraisers are used to providing estimates for their work, so feel free to reach out to ask for a quote.

Choosing a Diminished Value Appraiser

The appraisal industry is self-regulated and in most states there is no licensing requirement to be an appraiser. Almost anyone can call themselves an “appraiser.” Therefore, to hire an appraiser qualified to conduct your diminished value appraisal, look for the following:

- Membership in a professional appraisal organization, such as the International Society of Appraisers (ISA), ASA, or AAA

- A statement that the appraiser’s reports fully comply with the Uniform Standard of Professional Appraisal Practice (USPAP)

- Extensive experience or a specialty in conducting appraisals on motor vehicles

Here are few red flags that an appraisal may not be able to meet the standards needed to succeed in a claim:

- Automated tools, platforms or organizations that provide “cheap, fast and easy appraisals”

- Any mention or usage of formulas or standards used in generating a value opinion

- The “appraiser” is employed by a retail car dealership or insurance company

The more impartial the appraiser, the more credible the value opinion and the more likely an arbitration or court will find in your favor.

Next Steps If You Believe Your Vehicle Has Diminished Value

If you believe you may have a valid claim to diminished value for your vehicle, here’s a step-by-step plan:

- Gather all relevant documentation including your policy information, repair estimates and accident reports, pre- and post-loss photographs of the vehicle, ownership information, etc.

- Confirm that the fault lies with the other party involved

- Consult with an appraiser or legal counsel on the validity of your claim

- Obtain an independent appraisal

- Submit documentation to the insurer or your attorney

If you have any questions about the process or would like a second opinion, contact us for a consultation.

Final Thoughts

Diminished value is a real loss. If you decide to sell your vehicle post-accident, buyers will expect to pay less for a vehicle with prior accident damage. A credible third-party appraisal gives you negotiating leverage with the insurance company and, if necessary, evidence to use in a legal proceeding.

If you need a diminished value appraisal or would like a consultation on whether you are in a good position to submit a diminished value claim, contact us. Our primary service here at Wolf and Mare is professional vehicle appraisal and we’d love to help you.

Opinions shared in this article are those of the author, who is a professional appraiser with the International Society of Appraisers. Opinions share here do not constitute financial advice.

Wolf and Mare provides car finding, appraisals, and auction services for buyers and sellers of collector European cars. If you’re interested in acquiring an overseas car, give us a call or drop a line!