Is the Porsche Market Headed for Collapse?

Sean Rooks | February 9, 2026

Magnus Walker is selling 8 of his classic Porsches with RM Sotheby’s. Jerry Seinfeld has sold — and continues to sell — cars from his sizable Porsche collection that he no longer wishes to keep. Doug Demuro is done buying Porsches, sortof. These moves have caused some to ask “Is the collectible Porsche market headed for collapse?” Most Porsche enthusiasts are aware of the brand’s recent sales slumps, but surely that’s temporary and has no bearing on the classic market, right? In today’s Market Monday, I share the in-depth context and data I used to arrive at my answer to this question.

Porsche’s 20-Year Rise to Dominance

With a value of $41 billion, Porsche secured the title as the world’s most valuable luxury and premium brand for the eighth year in a row in 2025. Chanel and Louis Vuitton are the brands that most frequently spar with Porsche for the top spot, neither of which produce automobiles. Porsche’s brand value has increased by 77% since 2018 and the company has seen tremendous growth over the last 20 years. It’s difficult to imagine today that this powerhouse company was facing the real prospect of bankruptcy or corporate takeover in the early 1990s.

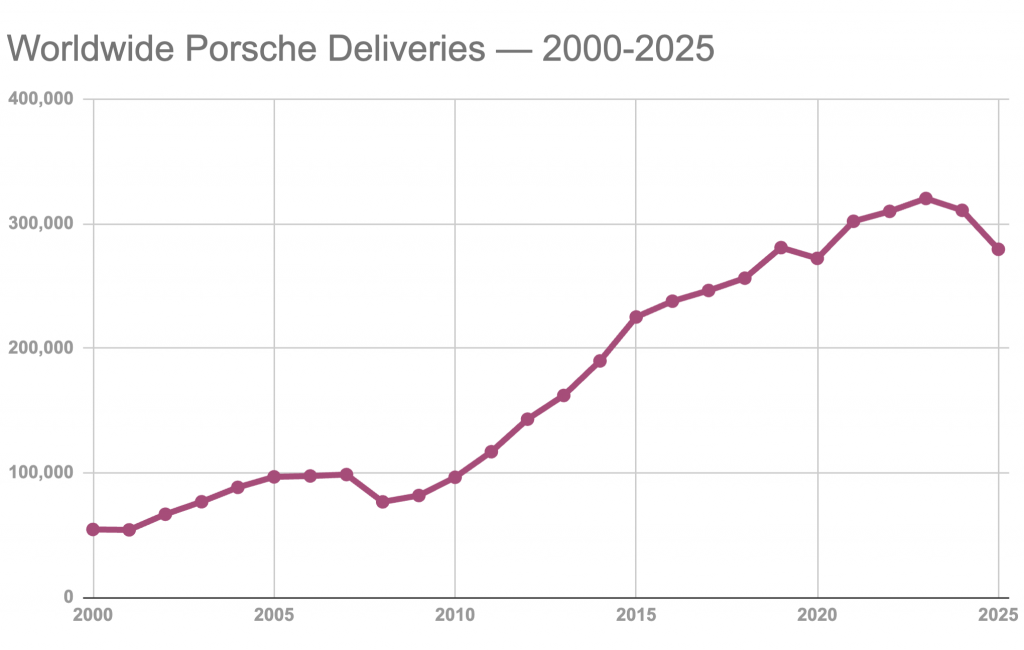

Between 1991 and 1994, Porsche was struggling with losses of around $300 million, requiring a major rethink of its strategy. The brand was selling 50,000 cars annually in the 1980s, but an international recession hit Porsche hard, despite the company producing high-quality and desirable sports cars. Four completely independent product lines (911, 944, 968, and 928) were extraordinarily costly to operate, especially with a sales volume of just 12,000 cars a year in 1992.

At a time when other sports car brands were being gobbled up via takeovers, such as Jaguar by Ford and Ferrari by Fiat, Porsche vowed to remain independent. A new board in 1991 ushered in a new strategy as well as a significant restructuring that resulted in a massive shift in how the company approached manufacturing. $1 billion was spent on developing two new models that would lower production costs through shared components and ignite sales through inspiring designs.

Those new cars were the 986 Boxster and 996-generation 911. The transition to a standardized and streamlined production process cut wasted time and materials, resulting in a faster build with reduced errors. Shared parts lessened development costs between the new models, which were remarkably similar save for engine position and details. This angered some purists but the public loved the Boxster, making it the best-selling Porsche until the Cayenne was released in 2003. Within a decade, Porsche was selling 70,000 units a year. Many brand lovers lamented the move, but those same folks can’t deny it opened up a new market that generated considerable success for the company.

Porsche continued to build on this strategy, entering the smaller SUV segment with the Macan and the EV market with the Porsche Taycan. The Porsche 911 halo car continued to improve through innovative technology and brought in considerable profit through ever more outrageous (and exclusive) track-focused GT variants. Motorsports domination at Le Mans further cemented the brand as a performance-focused and successful automaker. It was in this period that China became a massive market for the brand’s vehicles across the board, with sales in China making up 25% of total volume — besting the brand’s performance in its home market.

By 2018, Porsche was delivering over 250,000 vehicles annually, a far cry from its position in 1992. Porsche was now a formidable luxury and premium brand player.

Today’s Luxury Market

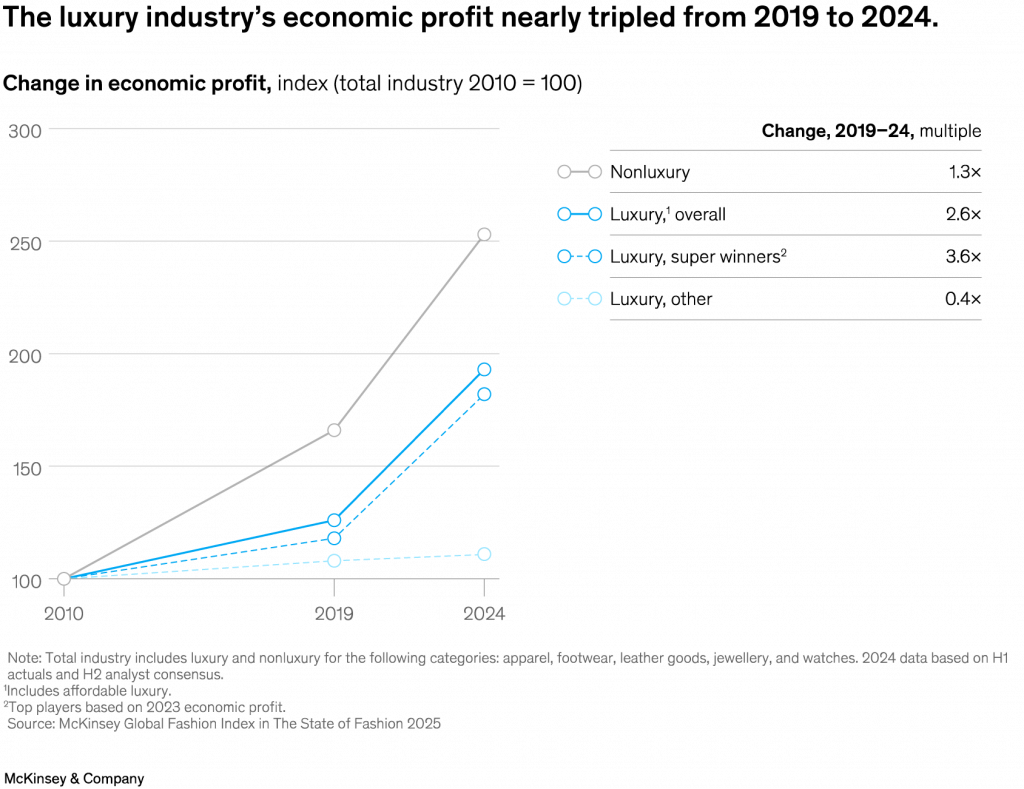

The luxury market overall experienced a period of incredible value creation from 2020-2025. Massive demand for luxury goods, including fashion, leather goods, watches, jewelry (and yes, automobiles) resulted in 5% annual growth rates. When a luxury brand pulls in over $5 billion a year, that’s huge.

While sales volume increased during this period, the dirty little secret is that price increases accounted for more than 80% of the growth, per McKinsey & Company. Costs for goods skyrocketed across every sector of the economy, but luxury brands saw their profit triple from 2019-2024.

After this boom in unprecedented growth and profit, the luxury industry is in a major slump. Luxury brands have reached a price ceiling — where demand starts to decline with each increase — and economic headwinds in China are depressing sales. China makes up 35% of luxury purchases and almost 20% of the growth in the industry, and sluggish post-pandemic growth and weak consumer confidence are reducing spending in that country. There’s a social component to this as well, with conspicuous consumption becoming less socially acceptable in China, reducing demand for ostentatious luxury goods.

Luxury demand is driven in large part by a sense of exclusivity, creativity and craft. After 5 years of exposure, luxury is everywhere and creativity largely absent. Buyers are starting to question the value provided by these brands and differing preferences among up-and-coming demographic groups — such as favoring experiences over goods — are going to require brands to adapt.

Brands that are able to reset for these new conditions with new strategies are the ones that will cope best with this period of slower growth.

Porsche is Once Again in Transition

Global sales for Porsche fell 10% in 2025, largely thanks to weak demand in China but also due to weaker than expected demand for electric models like the Taycan. Interestingly, North America was Porsche’s best performing market, despite the tariffs imposed by the new Trump Administration.

The entire auto industry was geared for an EV transition that has largely been reversed, at least in the United States, due to regulatory and policy changes. We’re seeing a pause in production of some EV models entirely and expensive development efforts initiated to re-introduce ICE models to future product lineups. Porsche was massively impacted by this shift, as it had abandoned the production of new gas-powered 718 and Macan models due to European cybersecurity regulations. The Macan is Porsche’s best-selling model and a gas-powered version is now in development for 2028. The outgoing version is still for sale in North America, though it is being phased out in Europe.

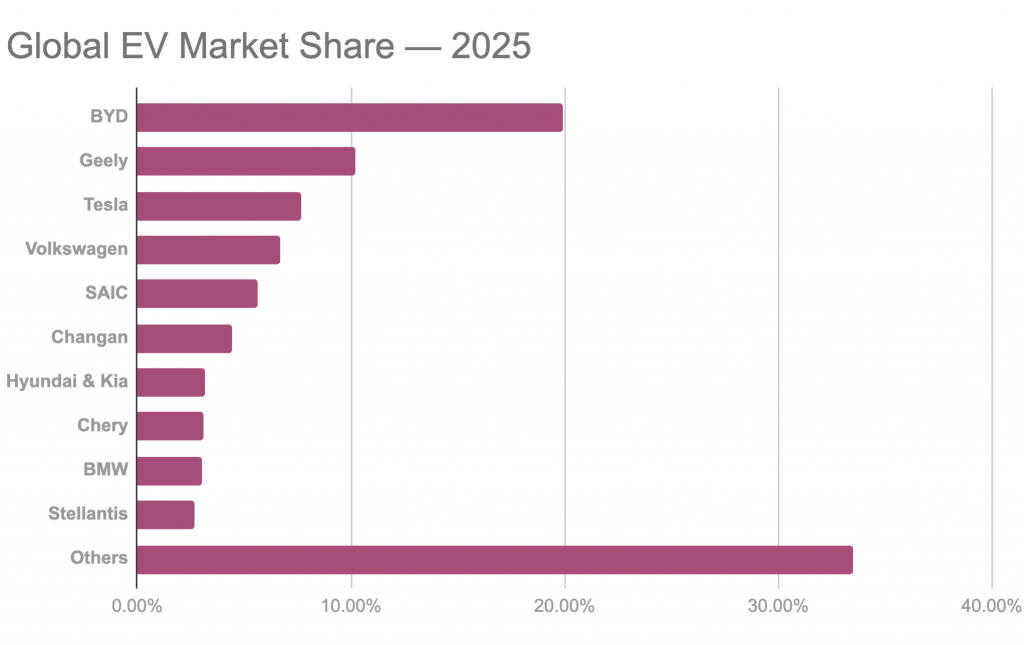

To make matters worse, electrification isn’t going away and the competition is getting fierce, especially due to CCP-driven investment in EV production. Huge subsidies and tax breaks are provided for electric vehicle development in China, an obvious play to harm the United States and dominate the industry (world?). For China, EVs are a useful tool for achieving political ends, but it also positions the Chinese EV industry as technologically advancing and forward-thinking — an important attribute that motivates buyers.

A sobering fact is that China is winning. Two-thirds of EVs sold worldwide are made in China and traditional auto brands are going to quickly look like they’re standing still or even regressing to younger buyers. China is succeeding the way it typically does — by shamelessly copying the designs and IP of Western companies and sacrificing profit for market share. For consumers squeezed by economic challenges, originality may take a back seat to affordability.

To Porsche’s benefit, it’s a mature brand that commands tremendous respect among the auto-buying public. It was ranked the most appealing premium brand in J.D. Power’s 2025 APEAL study, still ranks number 1 in the Customer Service Index, and it remains a darling among the automotive enthusiast community.

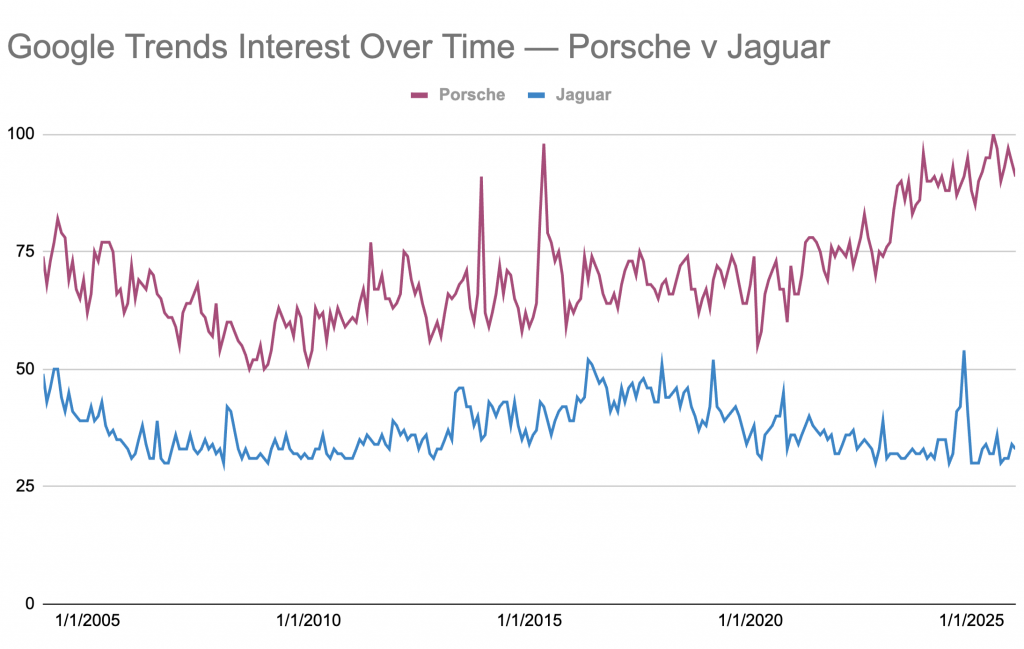

The popularity — and therefore value — of Porsche’s classic models is driven in some part by the strength of Porsche’s cultural and commercial relevance. Without the runaway success of the past 20 years, I seriously doubt we’d have the number of enthusiasts for the brand’s heritage models that we do today. If you’d like a comparison, look at the current state of Jaguar.

In the coming years, the strategic decisions Porsche makes in adapting to short-term realities while planning for long-term growth will be critical.

Warning Signs

So should you sell your classic Porsche or not? Well, that depends on why you bought it. Let’s assume you’re a shameless speculator who got into the brand for the promise of liquidity and quick gains. Here’s what I would consider some warning signs that, taken together, could signal a bleaker future for the classic P-car market.

Elite Abandonment

The Trickle-Down Theory (of fashion, not economics) holds that fashion thrives on the tension between conforming and differentiating oneself from the group. As the lower classes copy the tastes of the upper class, the elites adopt new fashions, leading to the mass-adopted trend to eventually fall from popularity. I’m seeing a few initial signs of fatigue with Porsche’s popularity in some circles. I wouldn’t count this as a serious trend yet and the brand remains massively popular, securing its stability for some time. However, if we start to see more highly influential acolytes of Porsche starting to downsize or scores of top-tier Porsches failing to meet reserves, this could signal a larger change.

EV Adoption Booms

A massive shift in the cultural appeal of electric vehicles among the influential could harm Porsche if it doesn’t have an answer for increased demand. The brand’s short-term strategic pivot to ICE vehicles makes financial and practical sense, but it could find itself lagging behind if it can’t compete in the EV marketplace with innovative and bold products. At the time of this writing, Porsche has articulated a value-over-volume strategy for China, but rumors are swirling that the 718 EV may be canceled. While such a move would save costs in the short-term, it could be a strategic blunder should tides shift. Porsche’s positive brand perception could be harmed as a result, leading to fewer modern Porsche buyers getting into heritage models.

Tons of Classic Porsches at Auction

Right now, I believe we see a generally healthy mix of cars at high-end and mid-tier level coming to market. In fact, the overall number of classic Porsches coming to auction in the last two years has been pretty stable. Yes, prices have softened, but that’s not a Porsche-specific phenomenon. If we start to see a lot of mid-grade and lesser classics flooding the market, then I’d start to worry that owners are looking to cut their losses and exit before a perceived downturn. Unfortunately, by the time you recognize this trend, you’re probably too late.

Final Thoughts

How well Porsche manages its current transition will have a downstream impact on classic Porsches. If the brand can sustain its prestige, the market may stay strong. If not, we could see a slow decline in values. Fortunately, the classic market is driven by heritage and passion rather than status alone, and the legacy of Porsche’s historic models are well-established.

Either way, we will see changes in the classic Porsche market. Rampant collecting to take advantage of a hot market has shifted to become a more thoughtful and personal journey. Acquisitions will be less about the hype and instead based on the vehicle’s inherent attributes and the collector’s connection to it. This is an adjustment to the current market realities and not necessarily a signal the market is tumbling.

At the moment, demographic shifts are having a major hand in the softer performance of some segments of the classic Porsche world. Volume cars from the 1960s are struggling a little more, while Porsches from the 1990s are booming.

In my opinion, the greatest risk to the classic Porsche market is a gradual erosion of liquidity and enthusiasm and not a sudden collapse, particularly for mid-tier cars whose values have been inflated by the brand’s immense growth in popularity over the past 20 years.

My advice, as always, is to buy what you love and ignore the noise. In other words, marry for love and not for money. Have a great week, everyone!

No generative artificial intelligence was used in the writing of this work. Opinions shared in this article are those of the author and do not constitute financial advice.

Wolf and Mare provides car finding, appraisals, and auction services for buyers and sellers of collector European cars. If you’re interested in acquiring an overseas car, give us a call or drop a line!